Delving into the realm of insurance requirements for architectural firms, this article aims to shed light on the crucial aspects that firms in this industry need to consider. From professional liability to workers’ compensation, we explore the various types of insurance coverage essential for safeguarding architectural practices.

Understanding Insurance Requirements for Architectural Firms

Insurance plays a crucial role in protecting architectural firms from potential risks and liabilities that may arise during the course of their operations. It provides financial security and peace of mind, allowing firms to focus on their projects without worrying about unforeseen circumstances.

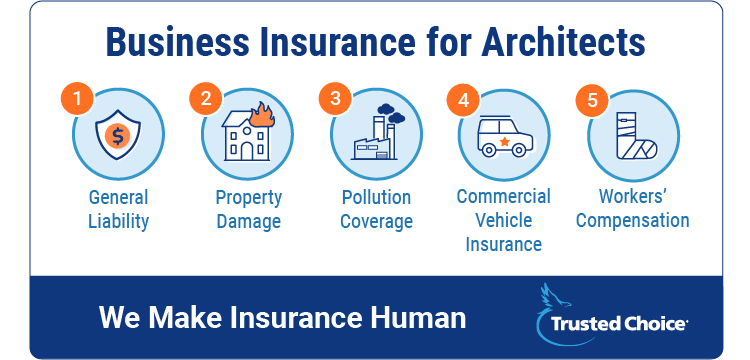

Types of Insurance for Architectural Firms

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects architectural firms from claims of negligence, errors, or omissions in their professional services.

- General Liability Insurance: This type of insurance covers third-party bodily injury, property damage, and advertising injury claims that may arise during the firm’s operations.

- Property Insurance: Property insurance protects the firm’s physical assets, such as office space, equipment, and computers, from damage or loss due to covered perils like fire, theft, or vandalism.

- Workers’ Compensation Insurance: This insurance is essential for covering medical expenses and lost wages for employees who sustain work-related injuries or illnesses.

- Business Interruption Insurance: Business interruption insurance helps cover lost income and expenses if the firm is unable to operate due to a covered peril, such as a natural disaster.

Risks Mitigated by Insurance Coverage

- Legal Claims: Professional liability insurance protects architectural firms from costly lawsuits resulting from alleged professional negligence or errors in design.

- Property Damage: Property insurance safeguards the firm’s physical assets, ensuring that any damage or loss does not disrupt operations or incur significant financial losses.

- Employee Injuries: Workers’ compensation insurance provides financial support for employees who suffer work-related injuries, reducing the firm’s liability and ensuring compliance with legal requirements.

- Business Disruptions: Business interruption insurance helps architectural firms recover financially after a covered event disrupts their operations, allowing them to resume work as quickly as possible.

Professional Liability Insurance

Professional liability insurance is crucial for architectural firms as it provides protection against claims of negligence or errors in the services provided to clients. This type of insurance helps cover legal expenses, settlements, and judgments that may arise from such claims, safeguarding the financial stability and reputation of the firm.

Examples of Claims Covered

- Design errors or omissions leading to construction defects

- Misinterpretation of client requirements

- Failure to meet deadlines or budgets

- Claims of professional negligence

Comparison of Policies

| Policy Type | Coverage Limit | Premium Cost |

|---|---|---|

| Claims-Made Policy | Specific per claim limit | Lower initial cost, may require tail coverage |

| Occurrence Policy | Aggregate limit per policy period | Higher initial cost, no need for tail coverage |

General Liability Insurance

General liability insurance is an essential coverage for architectural firms to protect against various risks and potential liabilities. This type of insurance provides coverage for claims involving bodily injury, property damage, personal injury, and advertising injury.

Coverage Provided by General Liability Insurance

- Protection against bodily injury: Covers medical expenses and legal fees if someone is injured on the firm’s premises or as a result of the firm’s work.

- Protection against property damage: Covers the costs of repairing or replacing property that is damaged as a result of the firm’s operations.

- Protection against personal injury: Covers claims of slander, libel, or invasion of privacy.

- Protection against advertising injury: Covers claims of copyright infringement, false advertising, or other related offenses.

Protection Against Third-Party Claims

General liability insurance protects architectural firms against third-party claims by providing coverage for legal defense costs, settlements, and judgments. If a client, vendor, or other third party files a claim against the firm for bodily injury, property damage, or other covered incidents, the insurance policy will help cover the costs associated with defending the firm and resolving the claim.

Obtaining and Renewing General Liability Insurance

Architectural firms can obtain general liability insurance by contacting insurance providers or working with insurance brokers to find the best coverage options for their specific needs. When obtaining insurance, firms should consider factors such as coverage limits, deductibles, and premium costs.

It is important to review and renew the insurance policy annually to ensure continued protection against potential liabilities.

Workers’ Compensation Insurance

Workers’ compensation insurance is crucial for architectural firms to protect both employees and employers in case of work-related injuries or illnesses. This type of insurance provides financial assistance to cover medical expenses, lost wages, and rehabilitation costs for employees who are injured on the job.

Benefits of Workers’ Compensation Insurance

- Financial Protection: Workers’ compensation insurance ensures that employees receive the necessary financial support to cover medical bills and lost wages without having to file a lawsuit against their employer.

- Legal Compliance: In many states, workers’ compensation insurance is mandatory for employers, and failing to provide it can result in hefty fines and legal consequences.

- Promotes Safety: Knowing that there is insurance coverage in case of an accident can encourage employees to follow safety protocols and procedures, ultimately creating a safer work environment.

Situations where Workers’ Compensation Insurance is Needed in an Architectural Firm

- If an architect falls from a ladder while inspecting a construction site and sustains injuries, workers’ compensation insurance would cover medical expenses and lost wages during recovery.

- In the event that an employee develops a work-related illness due to exposure to hazardous materials in the office, workers’ compensation insurance would provide support for medical treatment and rehabilitation.

- If a draftsperson injures their back while lifting heavy boxes of architectural plans, workers’ compensation insurance would assist with medical costs and potential disability benefits.

Property Insurance

Property insurance is crucial for architectural firms to protect their physical assets from unforeseen events such as fires, vandalism, or natural disasters. This type of insurance provides coverage for buildings, office equipment, furniture, and other valuable items owned by the firm.

Coverage Provided

- Property insurance typically covers damage or loss to the firm’s physical assets due to fire, theft, vandalism, or natural disasters.

- It may also include coverage for business interruption, which compensates the firm for lost income and ongoing expenses if operations are disrupted due to a covered event.

- In some cases, property insurance can also cover expenses related to temporary relocation or rebuilding of the firm’s office space.

Factors to Consider

- When selecting property insurance, architectural firms should consider the value of their physical assets to determine the appropriate coverage amount.

- It is important to assess the risks specific to the firm’s location, such as the likelihood of natural disasters or incidents like theft or vandalism.

- Architectural firms should also review the policy exclusions and limitations to ensure that they have adequate coverage for their unique needs.

- Working with an experienced insurance agent or broker can help firms navigate the complexities of property insurance and tailor a policy to fit their requirements.

Epilogue

In conclusion, understanding the insurance landscape for architectural firms is paramount in protecting their operations and assets. By comprehensively assessing and meeting these insurance requirements, firms can navigate potential risks with confidence and resilience.

FAQ Compilation

What are the key types of insurance architectural firms usually require?

Architectural firms typically need professional liability, general liability, workers’ compensation, and property insurance to protect their business.

How does professional liability insurance benefit architectural firms?

Professional liability insurance covers claims related to errors, omissions, or negligence in architectural services, safeguarding firms against potential lawsuits.

What risks can property insurance help architectural firms mitigate?

Property insurance can protect architectural firms against damage or loss of their physical assets, such as office space, equipment, and valuable documents.