Exploring incident insurance coverage for small businesses sets the stage for a compelling discussion, delving into the intricacies of protecting small enterprises from unforeseen events.

As we navigate through the nuances of incident insurance and its impact on small businesses, we uncover essential information that can safeguard these enterprises in times of crisis.

Overview of Incident Insurance Coverage for Small Businesses

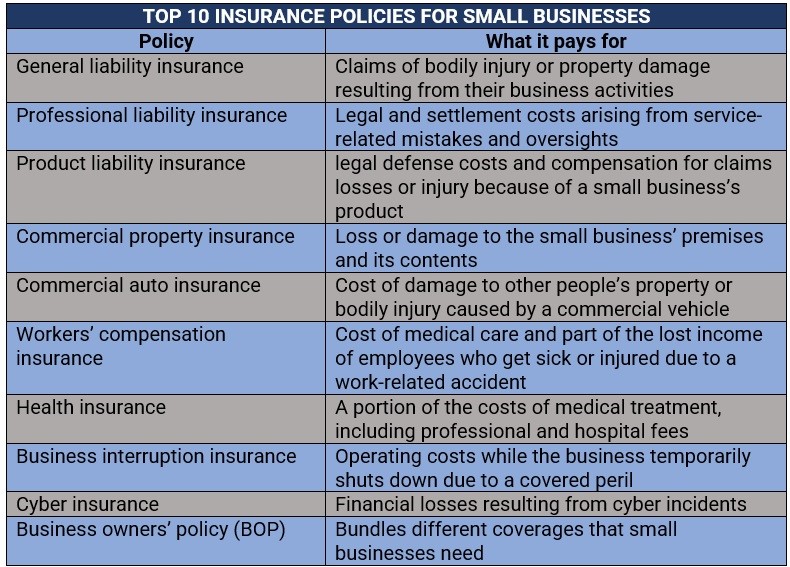

Incident insurance coverage for small businesses is a type of insurance that provides financial protection in the event of unexpected incidents that may cause damage or losses to the business. It helps businesses recover from unforeseen events and continue operations without facing significant financial burdens.

Importance of Having Incident Insurance for Small Businesses

Having incident insurance is crucial for small businesses as it safeguards them from potential financial risks that can arise from various incidents. It ensures that the business can weather unexpected events and continue to operate smoothly without facing severe financial setbacks.

Types of Incidents Typically Covered by This Insurance

- Natural disasters such as floods, earthquakes, hurricanes, and wildfires

- Accidental damage to property or equipment

- Theft or vandalism

- Business interruption due to incidents that prevent normal operations

- Liability claims from customers or third parties

Factors to Consider When Choosing Incident Insurance

When selecting incident insurance for their small businesses, there are several key factors that business owners should take into consideration to ensure they have the coverage they need in case of unforeseen events.

Coverage Needs

- Assess the specific risks your business faces: Different industries have different risks, so it’s essential to understand the unique vulnerabilities of your business.

- Consider the location of your business: Businesses located in areas prone to natural disasters may require additional coverage.

- Evaluate the value of your business assets: Make sure your insurance policy provides adequate coverage for your equipment, inventory, and property.

Policy Comparison

- Review the coverage limits and exclusions of each policy: Not all incident insurance policies are the same, so it’s crucial to compare the details of each policy to find the best fit for your business.

- Consider the cost of premiums versus the level of coverage: Balancing affordability with comprehensive coverage is key when choosing an insurance policy.

- Look at the reputation and financial stability of the insurance provider: Ensure that the insurance company has a good track record of paying out claims promptly and fairly.

Incidents Not Covered

- Acts of war or terrorism: Standard incident insurance policies may not cover damages resulting from acts of war or terrorism.

- Negligence or intentional acts: Incidents caused by negligence or intentional actions may not be covered by insurance.

- Pandemics or epidemics: Some policies may exclude coverage for losses related to pandemics or epidemics, as seen during the COVID-19 outbreak.

Costs and Benefits of Incident Insurance Coverage

When it comes to incident insurance coverage for small businesses, there are both costs and benefits to consider. Understanding these can help business owners make informed decisions about whether to invest in this type of insurance.

Costs Associated with Incident Insurance

- Annual Premiums: Small businesses will need to pay annual premiums to maintain their incident insurance coverage. The cost of these premiums can vary depending on the size of the business, the industry it operates in, and the level of coverage required.

- Deductibles: In the event of an incident, small businesses may be required to pay a deductible before their insurance coverage kicks in. This out-of-pocket expense can add to the overall cost of having incident insurance.

- Additional Coverage: Some small businesses may opt for additional coverage beyond the basic incident insurance policy. This can include coverage for specific types of incidents or higher coverage limits, which can increase the overall cost.

Benefits of Having Incident Insurance

- Financial Protection: Incident insurance provides financial protection to small businesses in the event of unexpected incidents such as accidents, natural disasters, or lawsuits. This can help businesses avoid significant financial losses that could otherwise threaten their survival.

- Peace of Mind: Knowing that they have insurance coverage in place can provide small business owners with peace of mind. They can focus on running their business without constantly worrying about the financial implications of potential incidents.

- Legal Compliance: In some cases, having incident insurance may be a legal requirement for small businesses, depending on the industry they operate in or the specific risks they face. Having coverage helps businesses comply with regulatory requirements.

How Incident Insurance Mitigates Financial Risks

By having incident insurance coverage, small businesses can mitigate financial risks in several ways. Firstly, insurance can cover the costs of property damage, liability claims, or legal fees resulting from incidents, reducing the financial burden on the business. Secondly, insurance can help businesses recover more quickly after an incident by providing funds for repairs, replacements, or other necessary expenses.

Ultimately, having incident insurance in place can help small businesses stay afloat during challenging times and protect their long-term financial stability.

Steps to Take in Filing an Incident Insurance Claim

When faced with an incident that requires filing an insurance claim, small businesses need to follow a specific process to ensure a smooth and successful outcome. Here is a step-by-step guide on what small businesses should do when filing an insurance claim, along with common pitfalls to avoid during the claims process.

Gather Essential Information

- Collect all relevant details about the incident, including the date, time, and location.

- Document any damages or losses with photographs or videos.

- Obtain contact information from any witnesses present during the incident.

Contact Your Insurance Provider

- Notify your insurance provider as soon as possible after the incident.

- Provide all necessary information and documentation to support your claim.

- Ask your insurance provider about the specific requirements for filing a claim.

Fill Out Claim Forms

- Complete the claim forms provided by your insurance company accurately and thoroughly.

- Double-check all information before submitting the claim forms.

- Include any supporting documents or evidence to strengthen your claim.

Cooperate with the Claims Adjuster

- Work closely with the claims adjuster assigned to your case.

- Provide additional information or documentation promptly if requested.

- Be honest and transparent throughout the claims process.

Avoid Common Pitfalls

- Avoid delaying the notification of the incident to your insurance provider.

- Do not exaggerate or provide false information in your claim.

- Avoid overlooking any details or documentation that may be crucial to your claim.

Closing Notes

In conclusion, incident insurance coverage for small businesses emerges as a vital shield against potential risks, offering a safety net that can preserve the financial well-being of these ventures. Dive into the world of incident insurance to fortify your business’s foundation.

FAQ Overview

What incidents are typically covered by insurance for small businesses?

Incidents such as property damage, liability claims, and business interruptions are commonly covered by insurance for small businesses.

How can small businesses choose the right incident insurance policy?

Small businesses should consider factors like coverage limits, deductibles, and specific risks they face to choose the most suitable incident insurance policy.

Are all incidents covered by standard policies?

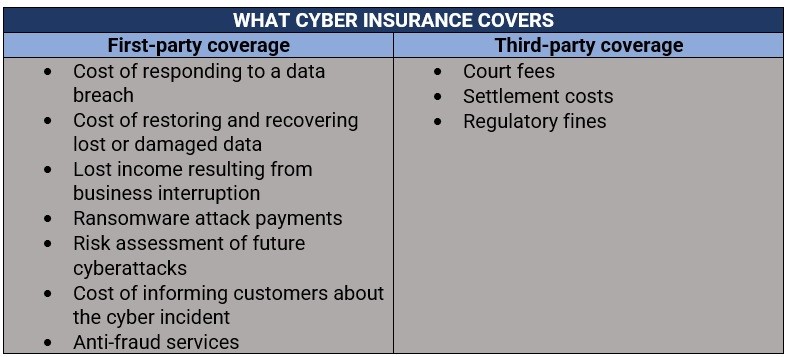

No, some incidents like natural disasters or cyber attacks may require additional coverage beyond standard policies.